Ask UK VAT question. Get an instant answer

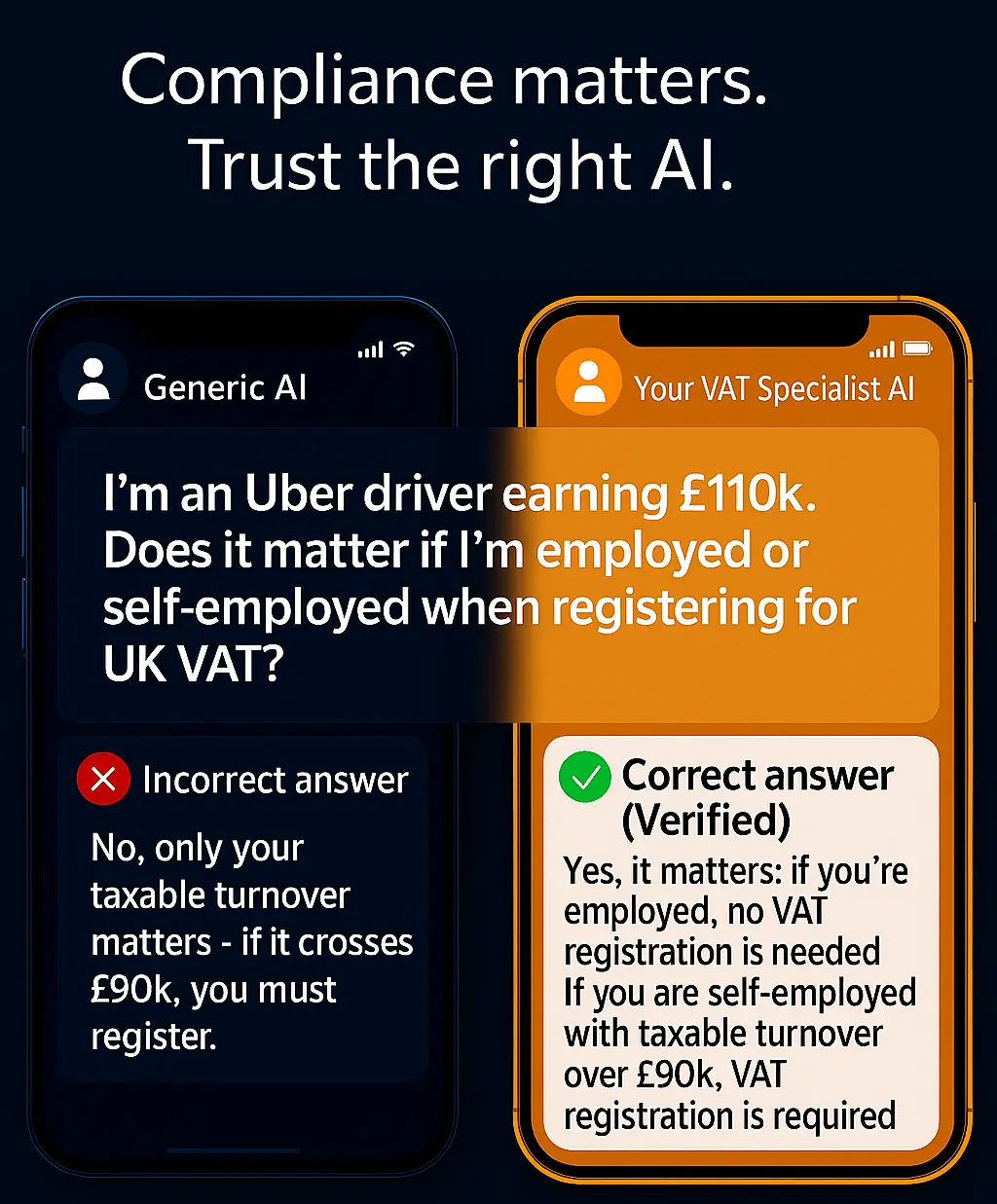

Navigating VAT rules, thresholds, and filings can be a challenge. Our new AI-powered compliance assistant is here to help.

This beta smart chatbot answers your UK VAT-related questions instantly, based on the latest official guidance from HMRC and other regulatory sources. Whether you’re figuring out when to register, how to file, or what the reverse charge means – our assistant gives you fast, easy-to-understand explanations.

Why try it?

Up-to-date, reliable answers

trained exclusively on official sources like HMRC

Clear explanations

of complex rules and thresholds

Avoid costly compliance mistakes

that could result in fines or blocked shipments

Your Reward for Helping Us Test

Try the chatbot and share your quick feedback (survey will pop up in the chat) – and you’ll get 3 months of free access once the full version launches.

- This tool is for informational purposes only – we do not provide tax advice

- Chatbot usage is subject to our Privacy Policy. Please avoid entering personal details that would allow to identify you or your company (such as your or your company name or contact details)